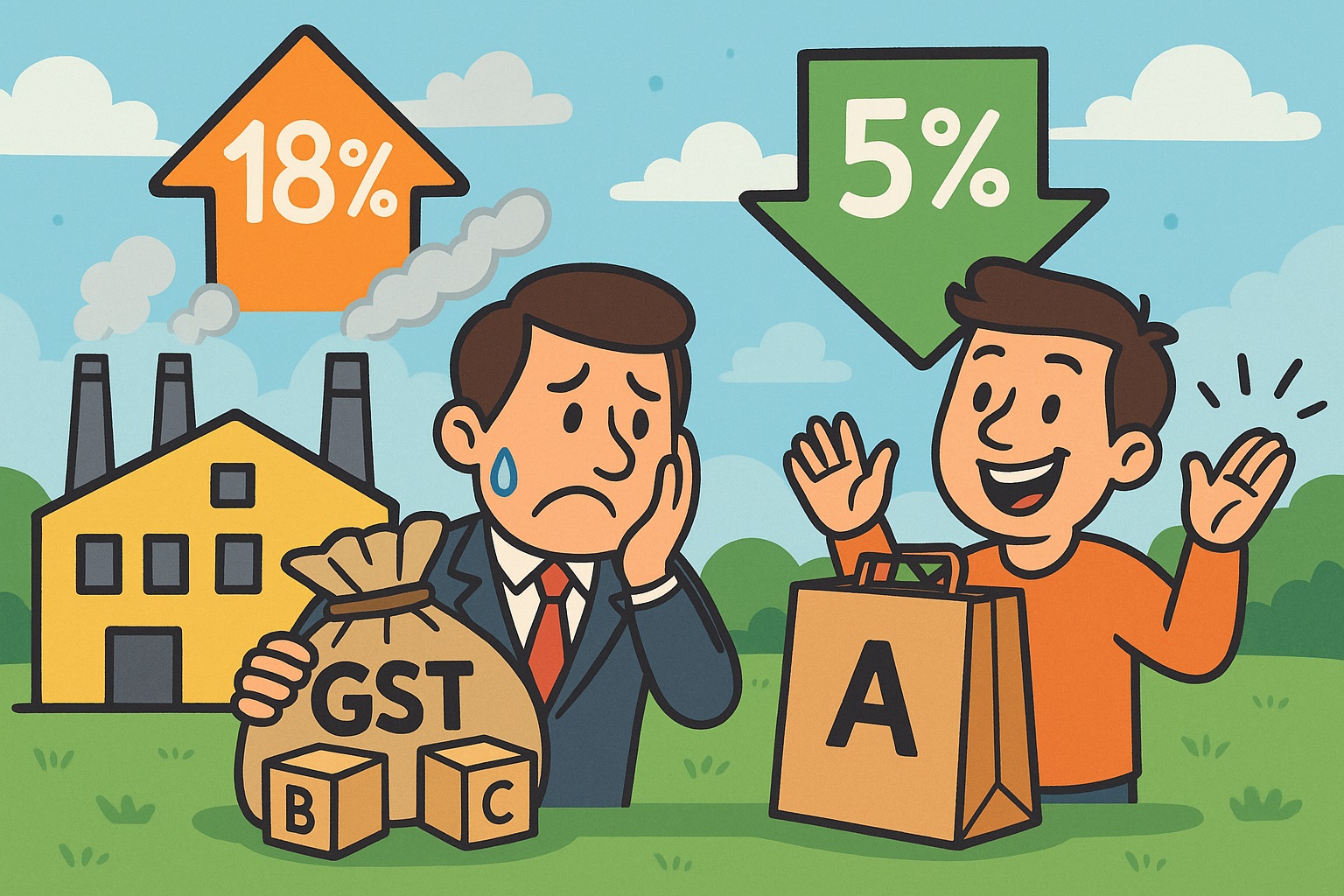

The 56th GST Council has recently announced a slew of changes as far as rates of goods and services are concerned. Most goods and services have had their rates reduced from 12% or 18% to 5%. While this may bring a smile to the face of the consumer, manufacturers of such goods may be in for some pain. Take the following example:

Item A requires raw materials B and C for manufacturing. Earlier all 3 were taxed at 18% GST. So A would be sold in the market for e.g. Rs 100 + Rs 18 GST. The cost of B and C was a total of Rs 60 (+ Rs 10.8 GST at 18%). The balance 40 is the cost of labour and profits. So the manufacturer would finally pay Rs 18 MINUS Rs 10.8 (on purchase) = Rs 7.2 GST to the Government, after factoring in the input credit.

After the rate change, Item A has become 5% but B and C continue to be 18%. In such a case, GST on the sale of A is now only Rs 5, and he has credit of Rs 10.8, so he doesn’t have to pay any GST to the Government (input credit more than output). However, this input credit keeps piling up and creates a cash flow blockage. THIS structure, i.e. when the GST rate on inputs is more than the GST rate on outputs, is known as an inverted duty structure.

Due to this, several industries are expected to face credit blockage due to recent GST rate changes. So, is this GST which has piled up lost? No. There is a provision to file and claim a refund of such GST under the Inverted Duty Structure refund.

Key Eligibility Requirements for such refunds

- The input tax rate must genuinely exceed the output tax rate

- The final product should not be nil-rated or fully exempt from GST

- The claim must be filed within the prescribed time limit of two years from the end of the financial year

- The taxpayer must have filed their GSTR-1 and GSTR-3B returns for the relevant tax period

- A trader cannot claim such a refund

- The refund is available only for input tax credit (ITC) on inputs (goods). ITC on input services like consultancy and freight cannot be claimed as part of the inverted duty refund. Similarly, ITC on capital goods is also excluded from the refund calculation

Businesses must file their inverted duty refund claims using Form GST RFD-01A on the GST portal. The application must be filed monthly for most taxpayers, though those with turnover up to Rs 1.5 crore who file quarterly returns can apply quarterly. If the refund amount is above Rs 2 lakh, then a CA certificate is needed.

New Provisional Refund Mechanism

Starting November 1, 2025, the GST Council has approved a revolutionary change in processing inverted duty refunds. Businesses will now receive 90% of their refund claims provisionally after automated risk checks, similar to the system already in place for exporters.

The new provisional refund mechanism is expected to provide significant relief to manufacturers, exporters, and MSMEs where working capital gets blocked due to inverted duty structures. This reform enhances cash flow, reduces compliance burden, and strengthens ease of doing business.

Action Points

- All manufacturers must check if the GST rate on their finished goods has been reduced

- Simultaneously, they must also check if the GST rate on their purchases is higher than that on their finished goods

- Next, check if due to the above, you will always have excess GST input credit

- If yes, and if your goods do not fall in the blocked for refund category, then you can prepare for filing a refund of such excess credit.

(The writer, a Fellow Chartered Accountant (FCA), specialising in Goods, Services tax, Transfer Pricing and Income tax, is the co-author of the book ‘Comedium of Industrial Policy for MSMEs in Goa’ released by ICAI)