Depositors rush to secure savings; society board members meet CM seeking restoration, Sawant asks to comply with Registrar’s queries

PANAJI

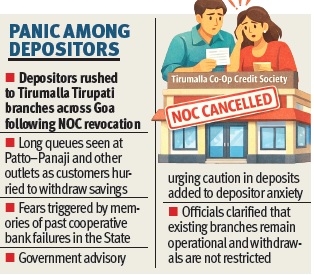

The Goa government’s decision to withdraw the extension of the No Objection Certificate (NOC) granted to Tirumalla Tirupati Multistate Co-operative Credit Society to open 13 new branches on Tuesday triggered a panic reaction from depositors, who rushed to its outlets across the State on Wednesday to withdraw funds.

The Cooperative Registrar had cancelled the NOC citing violations of terms and conditions, including failure to submit mandatory audit reports. The society, which currently operates 17 branches in Goa, has also been fined for non-compliance.

While existing branches will continue functioning, the Registrar has issued an advisory urging investors to exercise caution in making deposits or transactions.

The development sparked immediate concern among depositors, many of whom thronged the Patto-Panaji branch and other outlets to secure their savings.

Meanwhile, some members of the board of directors of the society met Chief Minister Pramod Sawant on Wednesday evening to seek a resolution and restore confidence among members.

After the meeting with the society's management, Sawant said, he had advised them to submit replies to the queries raised by the Registrar at the earliest.

"I have asked Tirumalla Tirupati Multistate Co-operative Credit Society to submit replies to the queries raised by the Registrar of Cooperative Societies, as fast as possible. Only after that the government can review the matter," Sawant said after the meeting.

The government's swift action against the society comes against the backdrop of recent turmoil in Goa's cooperative banking sector where financial irregularities in cooperative institutions such as Marcel Mahila Sahakari Bank and Visionary Sahakari Bank led to thousands of depositors losing significant sums of money.

The government has also struggled to fully contain frauds in the cooperative banking sector, evident in the Mapusa Urban Bank and Madgaum Urban Bank liquidation fiascos, even as new credit societies continue to be registered.

Officials said, the decision to block Tirumalla’s expansion was taken to safeguard public interest and prevent further risks to depositors.

The society’s inability to comply with regulatory requirements raised red flags, prompting the Registrar to act decisively.

Depositors on the other hand expressed anxiety over the situation, recalling past cooperative bank failures that eroded public trust.

The government’s advisory has added to their fears, though officials clarified that existing branches of Tirumalla Tirupati Multistate Co-operative Credit Society in the State remain operational and withdrawals are not restricted.

The Chief Minister is expected to review the matter following the society’s appeal. For now, the withdrawal of the NOC has underscored the fragile state of cooperative banking in Goa and renewed calls for stricter oversight to protect small investors.