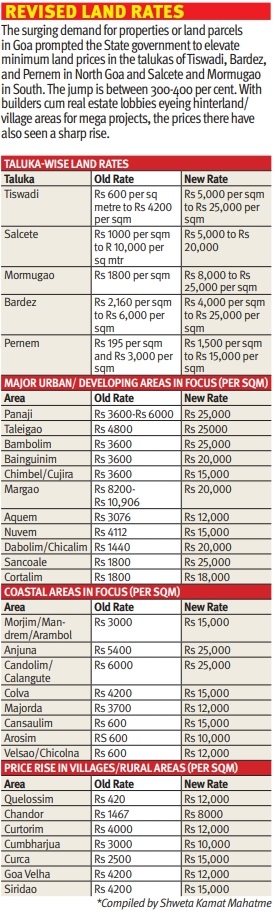

The State government's Revenue department last week notified revised base rates for land (real estate) in the three fast urbanising Mormugao, Salcete and Tiswadi talukas. Earlier in August, these rates were revised and notified for the two coastal talukas of Bardez and Pernem. While government officials claim the nearly 250% and 450% hike in rates for some locales is justified and much below the average rates of land deals registered at sub-registrar offices over a year, realtors and lawyers, many of who are engaged in vetting land ownership documents and drafting sale deeds, have raised an alarm. The Goan dissects the issue and elicits views from a cross section of stakeholders of Goa's controversial real estate sector

PANAJI

Some 15 years ago or thereabouts, real estate major DLF picked up a huge chunk of prime land in the capital city's plush business district -- Patto Plaza.

The deal the real estate company struck with the State-owned Economic Development Corporation (EDC) via a public bidding process (auction), became the talk of the town for the price it paid per square metre of the land transacted. In fact, the approximately Rs 50,000 per square metre value of the deal, and not the base price fixed by the State government's Revenue Department, started becoming the benchmark for all land deals thence.

The deal the real estate company struck with the State-owned Economic Development Corporation (EDC) via a public bidding process (auction), became the talk of the town for the price it paid per square metre of the land transacted. In fact, the approximately Rs 50,000 per square metre value of the deal, and not the base price fixed by the State government's Revenue Department, started becoming the benchmark for all land deals thence.

Fast forward to the present and the recent notification issued by the Revenue Department raises the base rate of 'Settlement' zone land to Rs 25,000 per square metre some 15 years later, quite explaining that invariably, government fixed rates for land are always significantly below 'market' rates. One of the reasons for it, explains a top Panaji-based realtor is that the government revisits notifying fresh base rates once every four to five years, a period during which tectonic changes happen which affects the demand and supply situation which in turn influences market land rates.

Rates last revised in 2020

The last time the State government had revised and fixed a fresh list of base rates in various parts of the State was in 2020, the year the COVID-19 pandemic hit and in a way drove up interest in land and real estate here as rich folk opted to relocate to quieter locales from crowded and busy metros and tier-II cities of the country.

That revision of the base land rates had come more than five years after they had been previously revised by the then Laximikant Parsekar government back in 2015-16. If revenue department sources are to be believed, a move to revise these base rates during the 2017-19) tenure of Manohar Parrikar was aborted first because of resistance from the 'real estate' lobby which had several advocates in his cabinet itself and later due to his illness and subsequent death in 2019.

When Chief Minister Pramod Sawant took over from Parrikar and the cabinet got rejigged, bureaucrats managed to revive the proposal and the government eventually issued the notification revising base rates in August 2020.

Govt's itch to join realty boom party and rake in the moolah!

A primary reason why the State government decided to revise the base rates first in the talukas of Bardez and Pernem in August and now in three other talukas of Salcete, Mormugao and Tiswadi, is to increase its revenue from the frenzied real estate activity and land transactions happening in the State.

The move will enable the government to collect more stamp duty and registration fees. One internal estimate of the government pegs the increase in revenue over the next year because of this hike in base rates at a whopping Rs 1,800 crore.

Another compelling reason for the government was the need to bring in some parity between its base rates and market values. "It is ridiculous that the government rate in the Bambolim area was Rs 3500 per square metre while the sale of land there was being executed at upwards of Rs 40,000 per square metre," a top Revenue Department official said.

"The government should not forego this huge revenue it was losing from these land transactions because of the ridiculously low base rates," the official said.

How were 250% & 450% higher rates for some locales arrived?

It is no secret that the actual value of any land transaction is much higher than the rates of land fixed by the government for the purpose of calculating stamp duties and sale deed registration fees.

However, the question is what is the level of disparity in the government rates and actual market rates? Is it 250 and 400 per cent as indicated in the quantum of increase in base land rates notified last week?

"Indeed and more," according to a high-ranking officer in the revenue department. The department has not come up with these new base land rates on hearsay or statistical formulae but used grounded reasoning and logic.

"What was done is that sub-registrars of these talukas were asked to calculate the average of the land rates in actually executed sale deeds over the last year for each locale. Further, after these average land rates were computed by the sub-registrars, they were further reduced by up to 50 per cent and then notified the rates," the top official said.

Across India, the methodology used by State governments to fix rates for land is more or less similar, taking data on rates from registered property deals in a particular vicinity, and recent developments related to infrastructure in the area but ignoring factors which influence demand and supply like announcements and development of new projects in the area like malls, airports and such other.

The bonanza govt expects

The rate at which the sale of land is being registered at the various sub-registrar offices across the five talukas where base land rates have been revised, the government expects to net some Rs 1,800 crore in revenue from stamp duty and registration fees, almost double the revenue it otherwise earned, estimates drawn by revenue department officials reveal.

With the revised rates, a much higher quantum of stamp duty and registration fees will have to be paid into the exchequer every time a sale deed of land is registered and according to revenue officials, the gross revenue earned in a year will be eight times the current levels.

Between stamp duty and registration fee, the current regime mandates payment of approximately 7 to 7.5 per cent of the total value of the land being transacted calculated on the basis of base value prescribed by the government, every time a sale deed is registered.