In a major relief, the State government today settled pre-GST arrears amounting to Rs 48 cr of around 16,400 odd traders under the one-time settlement scheme.

The scheme launched in October 2023 will be in place till March 7, 2024, during which the traders are asked to clear all their pending dues.

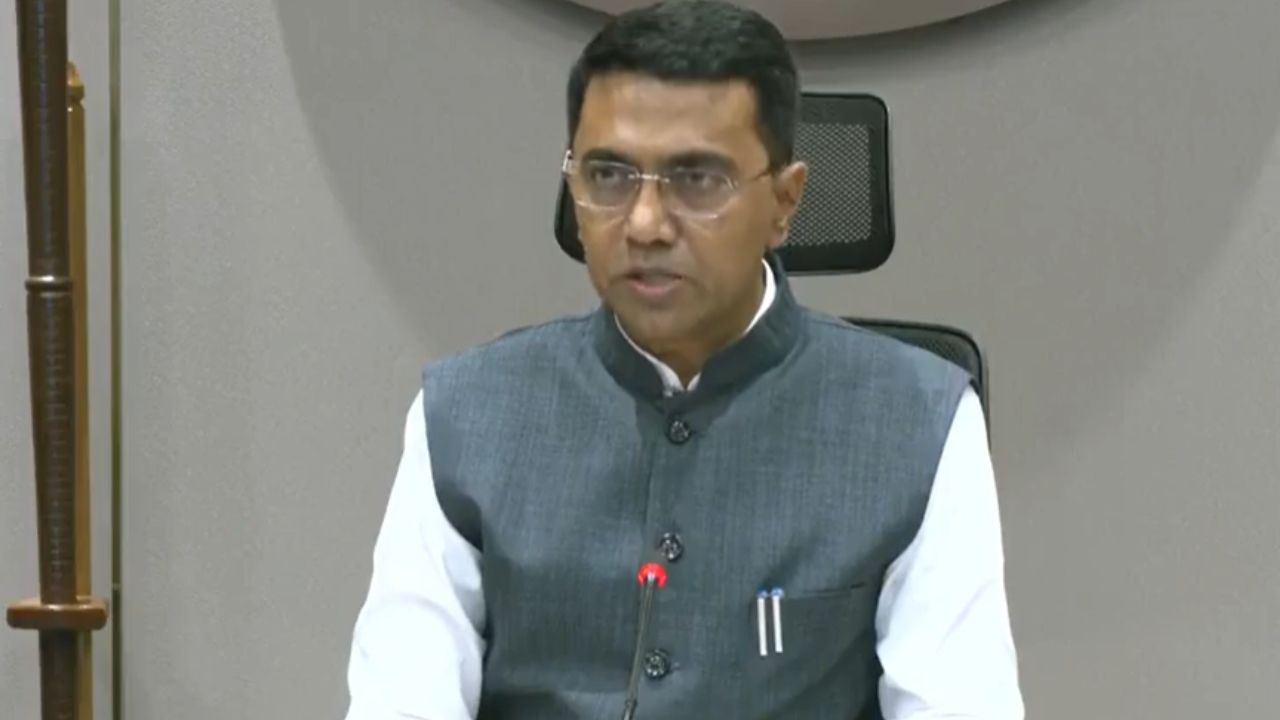

The Chief Minister Pramod Sawant said that no extension beyond March 7 would be granted.

The settlement has been done as per the Goa (Recovery of Arrears of Tax, Interest, Penalty, Other Dues through Settlement) Act 2023, which aims at resolving the legacy tax issues in the state up to June 30, 2017, under the Central Sales Tax Act, Goa Sales Tax Act, Goa Tax on Luxuries Act, Goa Entertainment Tax Act, and Goa Tax On Entry of Goods Act.

With a total of 16,412 cases benefiting from the scheme, Chief Minister Sawant also highlighted the government's commitment by forgiving a substantial amount of Rs 48.5 crores. However, the actual amount recovered exceeds expectations, contributing approximately Rs. 90 crore to the government treasury.

This scheme applies to individuals who, despite facing financial challenges, diligently cleared their daily IT returns, GST, and VAT obligations. Furthermore, those who paid an additional Rs. 10,000 will also experience relief through a 50% waiver, with over 1,300 applications already processed. "This initiative not only benefits the 16,412 individuals directly involved but also contributes to the overall financial well-being of the state," said CM Sawant.