ITC reversal only on exempt items; old-pack MRPs can be updated till March 2026 with stickers or revised price lists

PANAJI

Amid confusion among traders/ shopkeepers over the new ‘GST 2.0’ rate changes, the State government has clarified that the businesses are not required to reverse their input tax credit (ITC) on goods purchased at a higher rate, as long as the new rate is not zero. However, if goods become entirely exempt from GST, any existing ITC must be reversed.

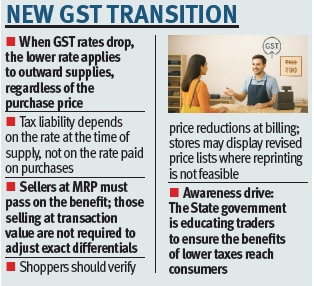

Further, it also explained that when a GST rate is reduced on goods, the new, lower rate applies to outward supplies, regardless of the rate at which the goods were purchased.

The GST Council has approved a complete overhaul of the goods and services tax regime, slashing tax on several commonly used items, from hair oil to corn flakes and personal health and life insurance from September 22 onwards. However, the transition had led to confusion among traders. As such, the government has initiated an awareness campaign to enlighten people about the benefits they stand to derive from lower prices through the latest restructuring of the indirect tax regime.

Speaking to The Goan, State Tax Commissioner S S Gill said that the government is currently undertaking an awareness drive to clear whatever confusion that is currently prevailing with the new GST 2.0 implementation. “Our aim is to see when a tax rate is reduced; the benefit must be passed on to the consumer,” Gill said.

Gill explained that under GST, the tax liability is determined on the basis of the rate in force at the time of supply, irrespective of the rate at which tax was paid on purchases. “Where is the question of refund? You have already raised ITC,” he said.

It is also been clarified that in case where the goods sold at a transaction value, which excludes GST, the supplier is not required to reduce the price by the exact differential; however, those selling at MRP, it is mandatory for them to pass on the benefit to the consumers.

The new GST reforms are being implemented across the country from last Monday, making a historical shift in the country’s indirect taxation with two slabs of 5 per cent and 18 per cent and a special slab of 40 per cent for sin goods.

As reported earlier, the old packaging can continue to be used until March 31, 2026, or until the stock runs out. MRPs on old packaging can be corrected using stickers, stamps, or even digital printing.

“In big showrooms or super markets, the price changes are made in the system itself. It is for the consumers to check, at the time of billing if they have got the benefit. Also in cases where reprinting MRPs is not feasible, sellers can display revised price lists in their shops to ensure consumers pay the reduced amount,” a senior officer said.